What Is Insurance?

Most people have some kind of insurance: for their car, their house, or even their life. Yet most of us don’t stop to think too much about what insurance is or how it works.

Put simply, insurance is a contract, represented by a policy, in which a policyholder receives financial protection or reimbursement against losses from an insurance company. The company pools clients’ risks to make payments more affordable for the insured.

Insurance policies are used to hedge against the risk of financial losses, both big and small, that may result from damage to the insured or their property, or from liability for damage or injury caused to a third party.

An insurance policy can protect you from the hazards of normal life, from floods and fires to car accidents and life-threatening illnesses. You can’t stop disasters from happening, but a good insurance policy can provide financial coverage for these unexpected expenses.

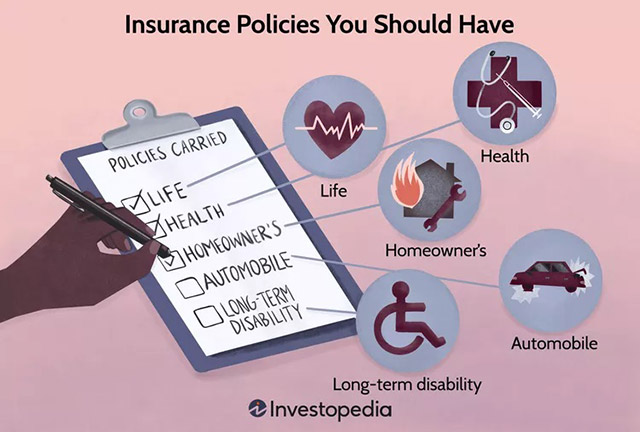

Protecting your most important assets is an important step in creating a solid personal financial plan, and the right insurance policies will go a long way toward helping you safeguard your earning power and your possessions. In this article, we discuss five policies you shouldn’t do without.

Long-Term Disability Insurance

The prospect of long-term disability (LTD) is so frightening that some people choose to ignore it. While we all think that “nothing will happen to me,” relying on hope to protect your future earning power is not a good idea. Instead, choose a disability policy that provides enough coverage to enable you to enjoy your current lifestyle even if you can no longer continue working.

Long-term disability provides a monetary benefit equal to a portion (e.g., 50% or 60%) of the insured’s salary for covered disabilities. Long-term disability typically begins when short-term disability ends. To receive benefits, the disability must have occurred after the policy’s issuance and then, typically after a waiting period. Medical information, often confirmed by a physician, must be provided to the insurer for consideration.

Most long-term disability insurance policies categorize disabilities as own occupation or any occupation.

Own occupation means the insured, due to disability, is unable to perform their regular job or a similar job. Any occupation means the insured, due to disability, is unable to perform any job for which they are qualified.

Similar to short and long-term disability insurance, workers’ compensation, or workers’ comp, it pays a monetary benefit to workers who become injured or disabled at work or while performing their jobs. Most states require employers to carry workers’ compensation insurance for their employees. In exchange, employees may not sue their employer for negligence.

While long-term disability insurance and workers’ compensation insurance both pay for disabilities, long-term disability insurance is not limited to disabilities or injuries occurring at work or while working.

1. Life Insurance

Life insurance protects the people that are financially dependent on you. If your parents, spouse, children, or other loved ones would face financial hardship if you died, life insurance should be high on your list of required insurance policies. Think about how much you earn each year (and the number of years you plan to remain employed), and purchase a policy to replace that income in the event of your untimely demise. Factor in the cost of burial too, as the unexpected cost is a burden for many families.

2. Health Insurance

The soaring cost of medical care is reason enough to make health insurance a necessity. Even a simple visit to the family doctor can result in a hefty bill. More serious injuries that result in a hospital stay can generate a bill that tops the price of a one-week stay at a luxury resort. Injuries that require surgery can quickly rack up five-figure costs. Although the cost of health insurance is a financial burden for just about everyone, the potential cost of not having coverage is much higher.

3. Homeowner’s Insurance

Replacing your home is an expensive proposition. Having the right homeowner’s insurance can make the process less difficult. When shopping for a policy, look for one that covers the replacement of the structure and the contents, in addition to the cost of living somewhere else while your home is repaired.

Keep in mind the cost of rebuilding doesn’t need to include the cost of the land since you already own it. Depending on the age of your home and the amenities it contains, the cost to replace it could be more or less than the price you paid for it. To get an accurate estimate, find out what local builders charge per square foot and multiply that number by the amount of space you will need to replace. Don’t forget to factor in the cost of upgrades and special features. Also, be sure the policy covers the cost of any liability for injuries that might occur on your property.

4. Renters Insurance

Renters also need peace of mind that they will be made whole in the event of a loss. Fortunately, renters insurance is a type of property insurance available to people who rent or lease properties. This insurance provides coverage for personal belongings, liability, and additional living expenses for covered losses.

For one property, there may be two types of property coverage: homeowner’s insurance and renters insurance. However, homeowners insurance does not cover the personal property of the tenant. Therefore, it is important for lessees to obtain renters insurance to protect their assets.

Although renters insurance differs from homeowners insurance, they have the same components: coverage A for the dwelling, B for other structures, C for personal property, D for additional living expenses (also known as loss of use), E for liability, and F for medical payments.

Because renters are not responsible for insuring the dwelling or other structures, coverages A and B are often set to $0.

Coverage C covers the personal property of the renter. Coverage D provides additional benefits for living expenses in the event of a loss. For example, if the renter is displaced from the home due to a fire, Coverage D provides covers the cost of living elsewhere, such as a hotel and food expenses. Coverage E provides coverage for injuries and property damage caused by the insured, and Coverage F covers medical expenses for guests of the renter on the property with permission.

5. Automobile Insurance

Some level of automobile insurance is required by law in most places. Even if you are not required to have it, and you are driving an old clunker that has been paid off for years, automobile insurance is something you shouldn’t skip. If you are involved in an accident and someone is injured or their property is damaged, you may be subject to a lawsuit that could cost you everything you own. Accidents happen quickly and the results are often tragic. Having no automobile insurance or purchasing only the minimum required coverage saves you only a tiny amount of money and puts everything else you own at risk.

Shop for Insurance Carefully

Insurance policies come in a variety of shapes and sizes and boast many different features, benefits, and prices. Shop carefully, read the policies, and talk to a licensed insurance professional to be certain you understand the coverage and the cost. Make sure the policies you purchase are adequate for your needs and don’t sign on the dotted line until you are happy with the purchase.

Consider enlisting the service of an insurance broker as they can search for policies across several insurance companies to find coverage that best suits your needs. Ask the broker to provide you with several options so you can compare features, provisions, and rates. Be in control of your protection by being well-informed to make a decision.

What Is a Whole Life Insurance Policy?

A whole life insurance policy is a permanent life insurance policy in which death benefits are paid upon the death of an insured. The whole life policy remains in force for the life of the insured as long as premiums are up-to-date. In addition to death benefits, whole life policies build cash value, which can be accessed during the insured’s lifetime.

What Is a Universal Life Insurance Policy?

A universal life (UL) insurance policy is permanent life insurance that allows the policyholder to invest their cash value in a separate account, which features funds tied to the stock market. It is a flexible policy, whereby premiums and death benefits can be adjusted.

How Do You Cancel an Insurance Policy?

A policyholder must cancel an insurance policy according to the cancellation provisions of their contract. Often, insurers allow policyholders to cancel by phone; however, some require the request in writing.

What Is an Umbrella Insurance Policy?

An umbrella policy is liability insurance that provides additional coverage in excess of the policyholder’s current policy limits. For example, if damages exceed the limits of a policyholder’s property insurance (e.g., home or auto), the umbrella policy will provide the additional liability coverage, up to policy limits. This type of insurance most benefits those with sizeable assets, which could be subject to seizure.

How Much Does a $1 Million Life Insurance Policy Cost?

The cost of a $1 million life insurance policy varies according to the type of life insurance issued—whole or term—the insured’s age, the insured’s health, and other underwriting factors. It could range from a few hundred dollars to thousands of dollars. The best way to find out how much a $1 million policy costs you is to get quotes from a life insurance agent or broker.

What Is the Cash Value of a Life Insurance Policy?

The cash value of a life insurance policy is the amount in excess of the premiums that has accumulated in the policy. Cash value is the savings component of a permanent life insurance policy that accumulates interest and can be accessed by the policy’s owner in the form of a cash withdrawal or a loan.

What Is the Declarations Page of an Insurance Policy?

An insurance policy declarations page is the part of the insurance contract that includes the general policy information. This page lists the policy owner, insured, the face amount of coverage, and terms and conditions.

The Bottom Line

In life, losses are inevitable, and the degree to which these losses impact our lives varies. Insurance lessens the impact by providing financial benefits for covered losses. There are many types of insurance available, but there are some which top the charts in terms of importance. Home or property insurance, life insurance, disability insurance, health insurance, and automobile insurance are five types that everyone should have.

source: investopedia